Asaan karobar Card Login and Online Application For Phase 2

Asaan karobar Card Login

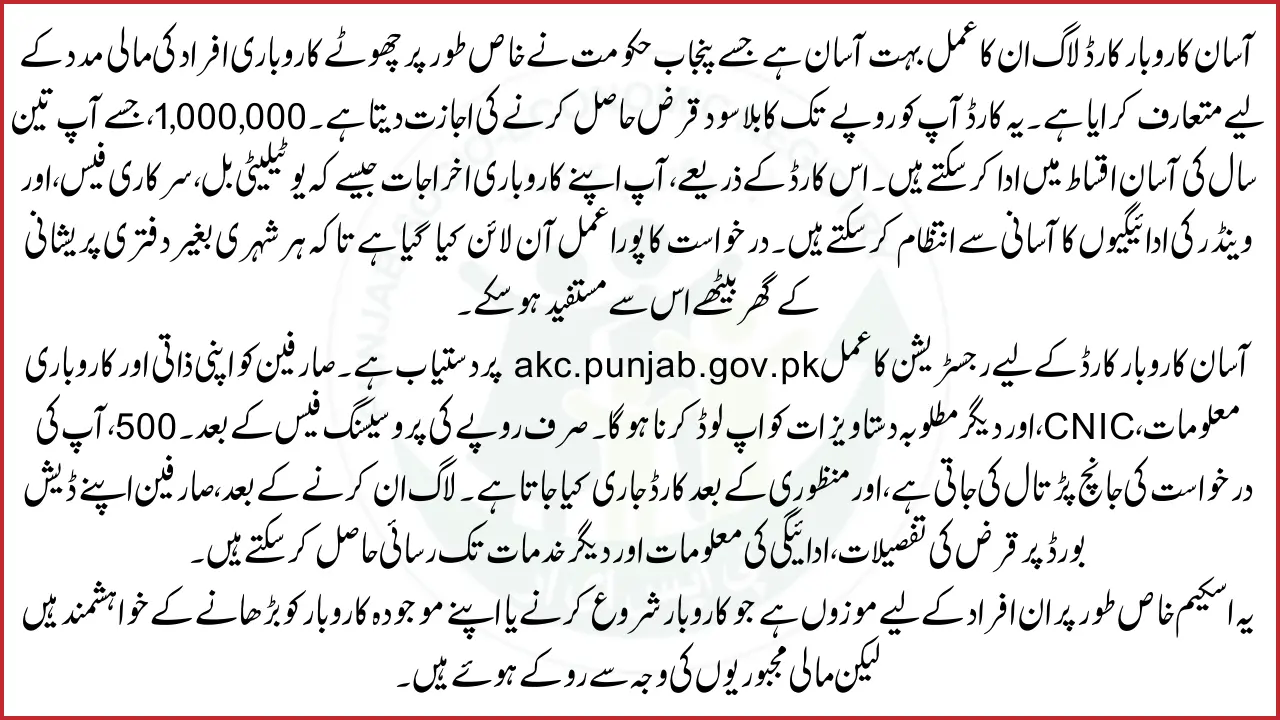

The Asaan Karobar Card Login process is very easy and simple, which has been introduced by the Punjab government especially for the financial assistance of small business people. This card allows you to get an interest-free loan of up to Rs. 1,000,000, which you can repay in easy installments of three years. With this card, you can easily manage your business expenses such as utility bills, government fees, and vendor payments. The entire application process has been done online so that every citizen can benefit from it, sitting at home without any office hassle.

The registration process for the Asaan Karobar Card is available at akc.punjab.gov.pk. Users have to upload their personal and business information, CNIC, and other required documents. After a processing fee of just Rs. 500, your application is scrutinized, and the card is issued upon approval. After logging in, users can access loan details, payment information, and other services on their dashboard.

This scheme is especially suitable for those individuals who are keen to start a business or expand their existing business but are held back due to financial constraints. This initiative of the Punjab government will not only create employment opportunities but also strengthen the economy of the province. If you are also a small entrepreneur, register today and take advantage of the Asaan Karobar Card.

Overview of the Asaan Karobar Card Scheme

The Asaan Karobar Card is a financial assistance scheme launched by the Punjab government under the leadership of Chief Minister Maryam Nawaz Sharif. It offers interest-free business loans with easy repayment options to help startups and existing small businesses expand their operations.

- Loan Limit: Up to PKR 1 million

- Interest Rate: 0% (Interest-free)

- Loan Type: Revolving credit facility

- Repayment Period: 3 years

- Grace Period: 3 months before repayment starts

- Processing Fee: PKR 500 (non-refundable)

- Annual Card Fee: PKR 25,000 + FED

A total of PKR 84 billion has been allocated for this scheme, with PKR 48 billion specifically for the Asaan Karobar Card. This program reflects the government’s strong commitment to strengthening the economy and generating employment through entrepreneurship.

Read More: 5000 Ramzan Package Check Online and Receive Financial Aid Through Govt of Pakistan

How to Apply for the Asaan Karobar Card

Follow these simple steps to complete your application online:

Visit the Official Website

- Open your browser and go to akc.punjab.gov.pk.

Fill in the Application Form

- Enter your personal and business details accurately.

- Provide your CNIC number, contact details, and other required information.

Upload Required Documents

- CNIC (front and back)

- Proof of residence (utility bill, rent agreement, etc.)

- Any relevant business documents

Pay the Processing Fee

- A non-refundable fee of PKR 500 is required to proceed with your application.

Verification Process

- Your details and documents will be verified by authorized agencies.

Approval and Card Issuance

- Once approved, you will be issued an Asaan Karobar Card, which can be used for business-related transactions.

You Can Also Read: How to Check PSER Registration Status Online Via 8070 SMS

How to Register for the Asaan Karobar Card

Registration is required before you can log in. Here is how to register step-by-step:

Access the Portal

- Visit akc.punjab.gov.pk and click on “Register Now”.

Provide Personal Details

- Full name as per CNIC

- CNIC number

- Date of birth

- Father or husband name

- CNIC issuance and expiry date

Enter Contact Information

- Mobile number (ensure it is active)

- Select your mobile network

Create Your Account Password

- Choose a strong password and confirm it by entering it again.

Review and Submit

- Double-check all details before hitting the submit button.

- You will receive a confirmation SMS upon successful registration.

Also Read: Complete Guide About Negahban Ramzan Package 2025 for Punjab Beneficiaries

Asaan Karobar Card Login Process

Once you have successfully registered, follow these steps to log in:

Go to Login Page: Open akc.punjab.gov.pk and click on the “Login” button.

Enter Your Credentials: Enter your CNIC number and then enter the password you created during registration

Access Your Dashboard: Click “Login” you will be redirected to your dashboard where you can track your application status, loan details, and more.

Tips for Smooth Login:

- Ensure your internet connection is stable

- Double-check your CNIC and password

- Keep your password safe and do not share it

Also Read: Maryam Nawaz Ramzan Relief Package 10000 Know Complete Guide

Eligibility Criteria for Asaan Karobar Card

To qualify for the scheme, you must meet the following conditions:

- Must be a Pakistani citizen residing in Punjab

- Age between 21 to 57 years

- Must have a valid CNIC and active mobile number

- Should own or plan to start a business in Punjab

- No overdue loans or poor credit history

- Businesses should be registered with PRA/FBR within 6 months of approval

- Only one application per person or business is allowed

Loan Usage and Repayment Terms

- First 50% of Loan: Available in the first 6 months

- Second 50%: Released after proper usage and timely repayment of the first half

- Grace Period: 3 months

- Monthly Installments: Minimum 5% of the outstanding balance

- Final Repayment: Balance paid in equal monthly installments over 2 years

Loan funds can only be used for:

- Vendor payments

- Utility bills

- Government fees

- Taxes

- Equipment purchase

Personal use or non-business transactions are strictly prohibited.

Read More: Ramzan Negahban Check Online to Get Benefits of 10000 Cash Under Ramzan Package

Fees and Other Charges

- Annual Card Fee: PKR 25,000 + FED (deducted from approved loan)

- Late Payment Charges: As per bank policy

- Other Charges: Life insurance, card delivery, and related admin costs

How to Track Your Loan Application Status

There are several ways to check the status of your Asaan Karobar Card application:

Online Portal

- Log in to your account on akc.punjab.gov.pk and check updates in real-time.

SMS Service

- Send “STATUS [Your Application ID]” to 8300

Helpline

- Dial 051-9053333 (within Pakistan)

- For international applicants, dial +92-51-9053333

BOP Branch

- Visit any Bank of Punjab branch with your CNIC for in-person inquiry.

What to Do If Your Application is Delayed

- Use multiple methods to check status

- Upload any missing documents via your account

- Ensure all data matches your NADRA records

- Contact support using your reference number

Key Benefits of the Asaan Karobar Card

- Interest-Free Loans: Financial help without the burden of interest

- Digital Transactions: Easy to manage through mobile and POS systems

- Cash Withdrawal: Up to 25% of the loan amount available in cash

- Revolving Credit: Flexible usage and repayment model

- Business Growth: Ideal for operational expansion and sustainability

You Can Also Read: How To Receive 10000 Cash Payment Through 8070 Ramzan Relief Package 2025

Conclusion

The Asaan Karobar Card Login and registration process is designed to be user-friendly, allowing entrepreneurs from every corner of Punjab to apply for financial assistance easily. With interest-free loans, simple eligibility criteria, and a secure digital platform.

This scheme is a golden opportunity for small business owners. If you have a dream to start or grow your business, this card can be the support you need to make it a reality.

FAQs

Who can apply for the Asaan Karobar Card?

Residents of Punjab aged 21 to 57 with a valid CNIC and a business plan are eligible.

How much loan can I get?

You can apply for a loan of up to PKR 1 million.

Is this loan interest-free?

Yes, it is entirely interest-free.

What is the repayment timeline?

Repayment starts after a 3-month grace period and is completed over 3 years.

How can I apply?

Visit akc.punjab.gov.pk and follow the online application process.

Can I withdraw cash from the loan amount?

Yes, up to 25% of the loan amount can be withdrawn for business-related needs.